Sell Return & Refund Guide

How to do a Sell Return

Method 01: Select the parent sale for each returned sale.

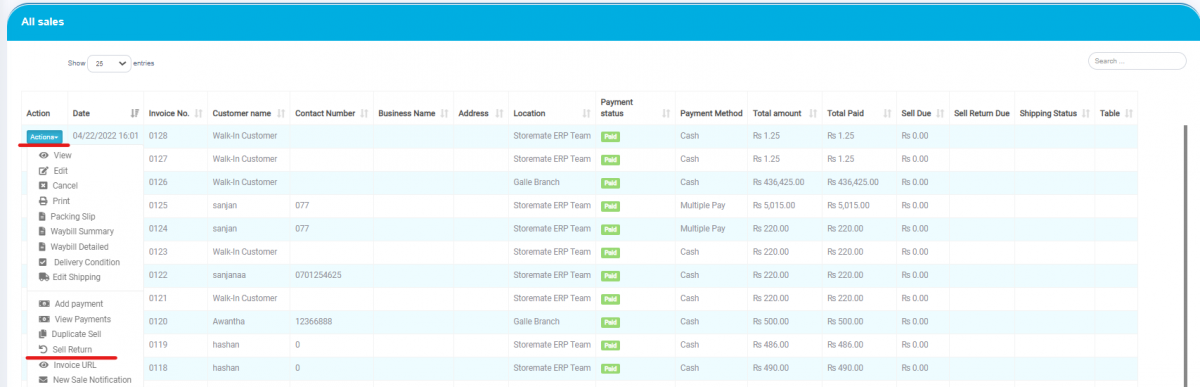

- Go to Sale > All Sale > Return Sale.

Click the action button on the parent Sell invoice, then select the sell return option.

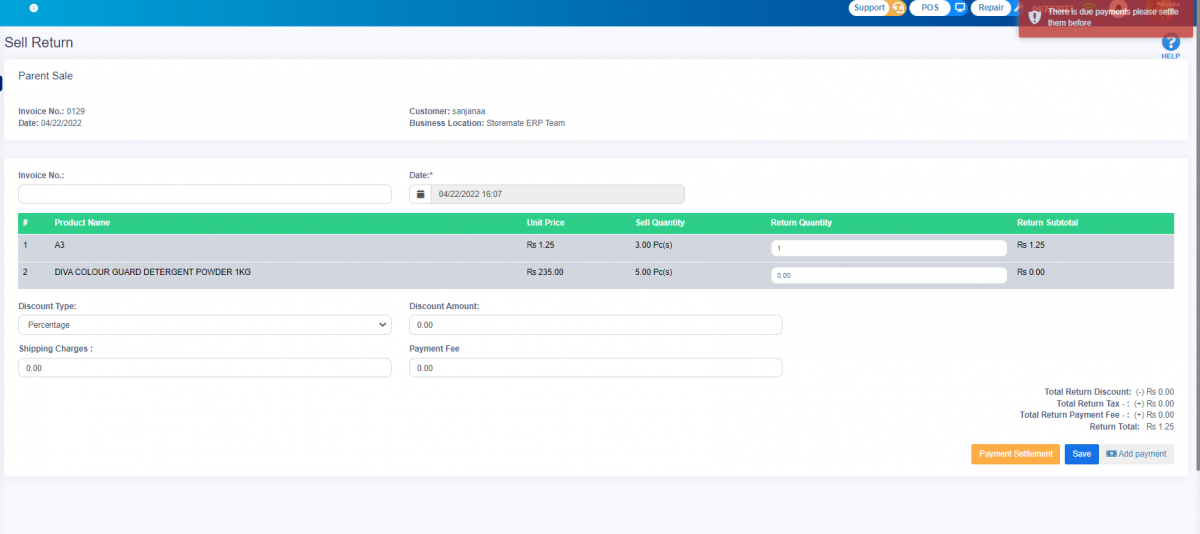

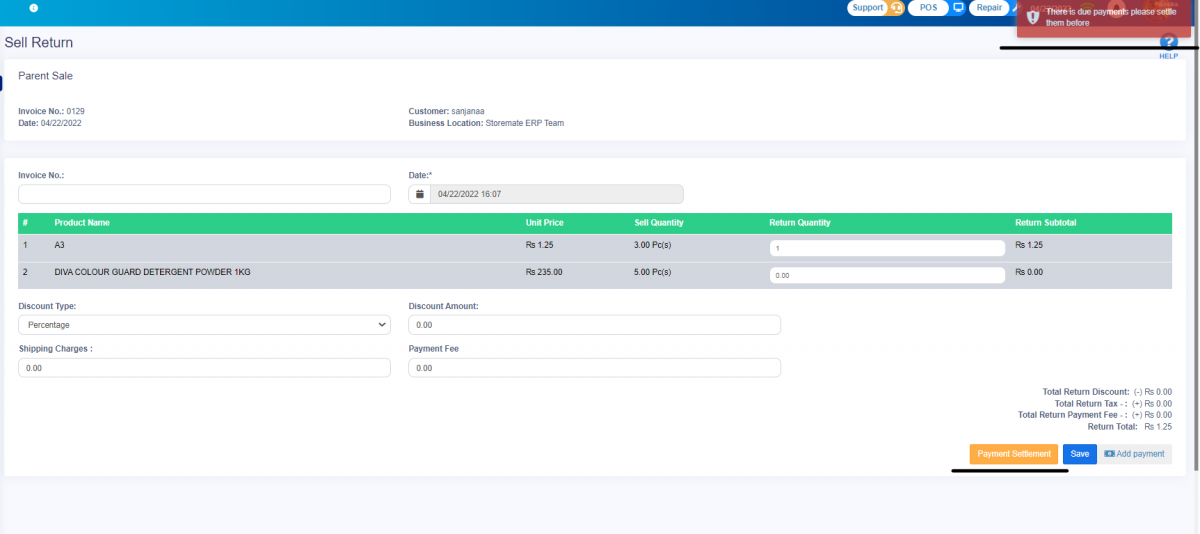

Enter the quantity of the return sales item.

After clicking the save button, a notification will pop up for items requiring settlement.

Now, press the Payment Settlement button to proceed with the settlement.

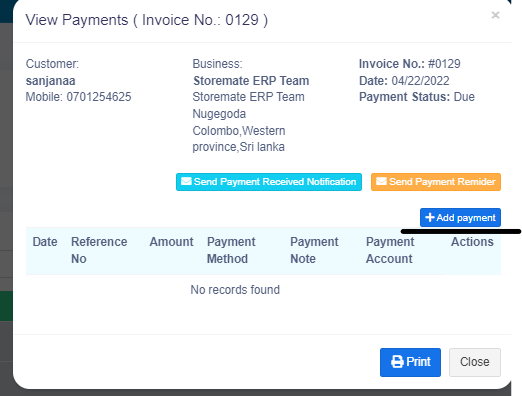

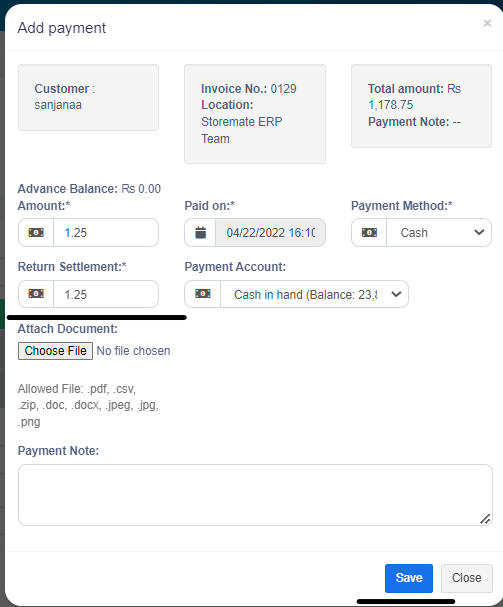

Press the “Add Payment” button. The settlement amount will display automatically. Save and finalize it afterward.

Icons & Labels

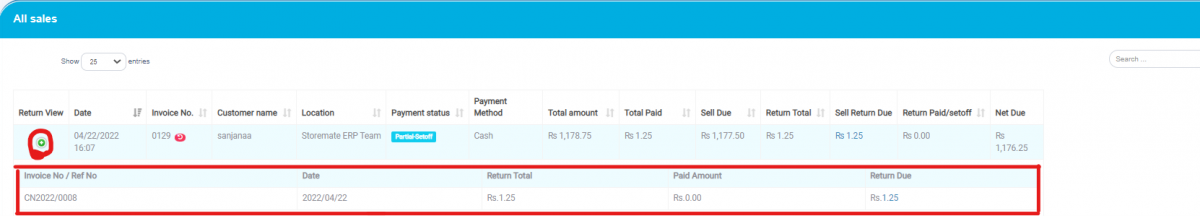

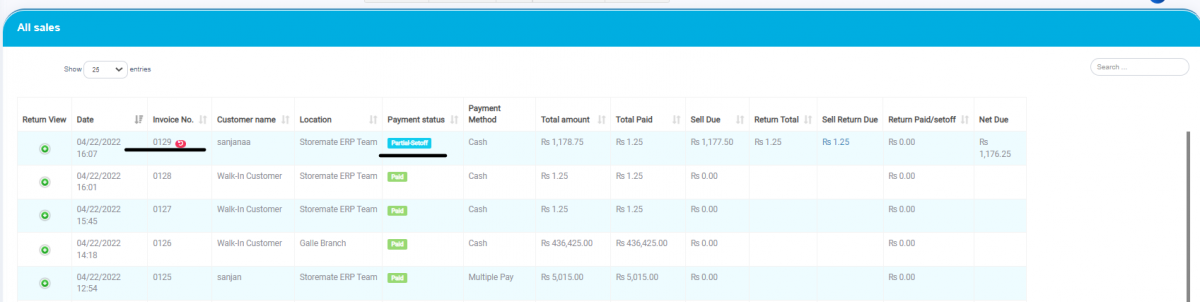

If there are returned items on the parent sale, you will see a red icon (return icon) near the Invoice Number.

If the payment has been settled, a “Setoff” label will appear under the payment status.

For due payments or partial settlements, a blue label named “Partial Setoff” will appear in the payment status.

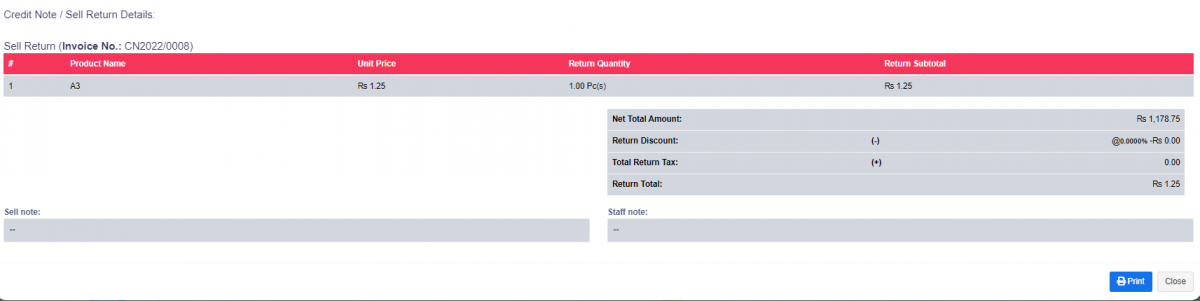

View Credit Note & Sell Returned Details

To view credit notes or sell return details, navigate as follows:

- Sell > All Sale > Parent Sale > Action > View

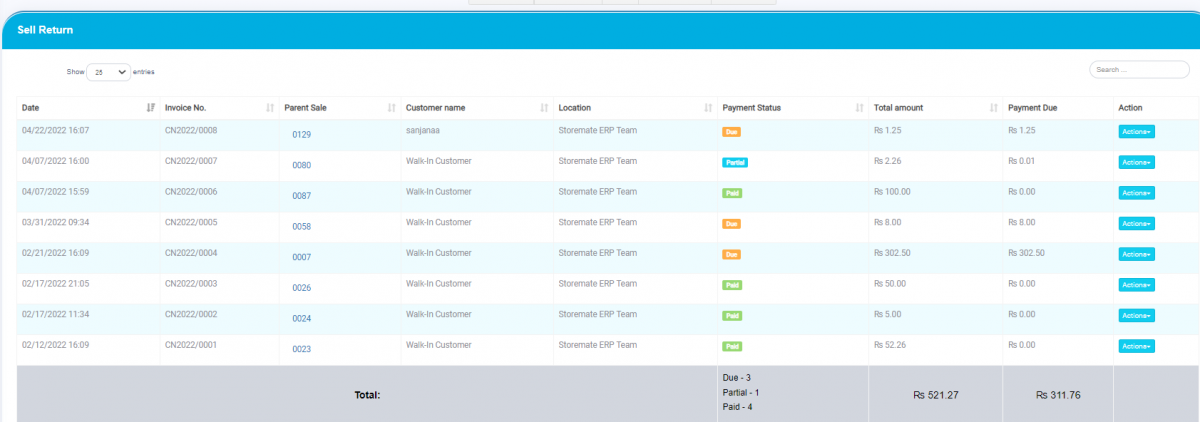

Sell Return Filters

From the List Sell Return option, you can view sell returns under the following filters:

- Business Location

- Customers

- Date Range

- User

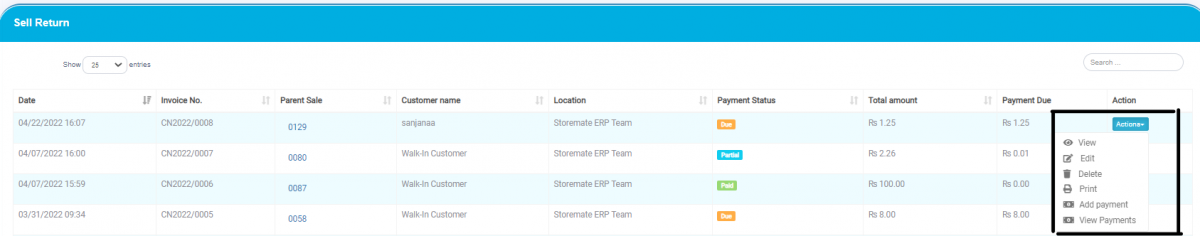

Action Button Options

Using the Action button, you can:

- View

- Edit

- Delete

- Add Payment

- View Payment

Return Settlement Tab

In the Return Settlements tab, you can view all settlements for returned items. Click the green plus icon to view additional settlement details.

Navigate to: Sell > Return Settlements